The Great Go-to-Market Reset, Part 1: The Funnel is Now a Black Box

The old GTM playbook is broken, and AI is the culprit. But this isn't another doomsday post. It's an honest exploration of what the data is telling us & what it feels like on the ground.

Let's start with a bold statement, as is tradition: the B2B Go-to-Market playbook that built a generation of SaaS companies is fracturing. (Calling things "dead" is a bit cliché, but "fracturing" feels about right… right?!)

For the last decade, we operated on a simple, comforting premise: create good content, rank on Google, get clicks, capture leads, and measure everything in a neat little funnel. (And let's be honest, it was never that neat to begin with.)

That model is breaking down. This doesn't feel like a temporary dip or a cyclical trend; it feels like a permanent, structural shift, driven by the AI intermediaries that have wedged themselves between you and your customers. Instead of pretending I have a crystal ball, this is my attempt to connect the dots, to look at what the data says, what it could mean, and the new questions it forces us to confront.

This is more than just a marketing problem. I'm convinced it's a CEO-level, board-level crisis impacting the fundamental unit economics of your business.

If you're a B2B SaaS leader, you're likely feeling this already. You're seeing once-reliable organic traffic flatten, your Customer Acquisition Costs (CAC) spiral, and the blame game between sales, marketing & customer success getting louder.

This is the chaotic reality of "The Great SaaS Reset." And the core enemy we've been fighting for years, the Data-Decision Disconnect, has just been given a massive upgrade.

What the Data Seems to Be Telling Us

For those who still think this is just about a few "AI Overviews" on Google, the data paints a brutal picture of the new buyer journey.

Your Buyers Are Outsourcing Their Research: The B2B journey no longer starts with a Google search bar. It starts with a chat prompt. Analysts indicate that up to 90% of B2B buyers now use AI tools in their purchasing process. They aren't just "using" AI; they're letting it do the initial work of discovery for them. For me personally, Perplexity has largely replaced Google, and every in-depth question becomes a Gemini Deep Research query. (Seriously, if you haven’t tried this yet, you should. It’s a glimpse of the future.)

The Clicks Are Vanishing: The traffic leak is real and quantifiable. A rigorous Ahrefs analysis found that the mere presence of a Google AI Overview causes the click-through rate for the #1 organic result to drop by a staggering 34.5%. For the informational "top-of-funnel" queries our content has historically relied on, some studies suggest generative answers are soaking up as much as 60% of user intent.

The Value Exchange is Broken: This is the part that strikes me most. The entire economic model of content marketing was a fair trade: we provide value, and we get traffic in return. That deal is off. AI platforms systematically scrape expert content, but the referral traffic they send back is a rounding error. Ahrefs data shows AI chatbots account for a mere 0.1% of total referrals. They take the value and keep the audience.

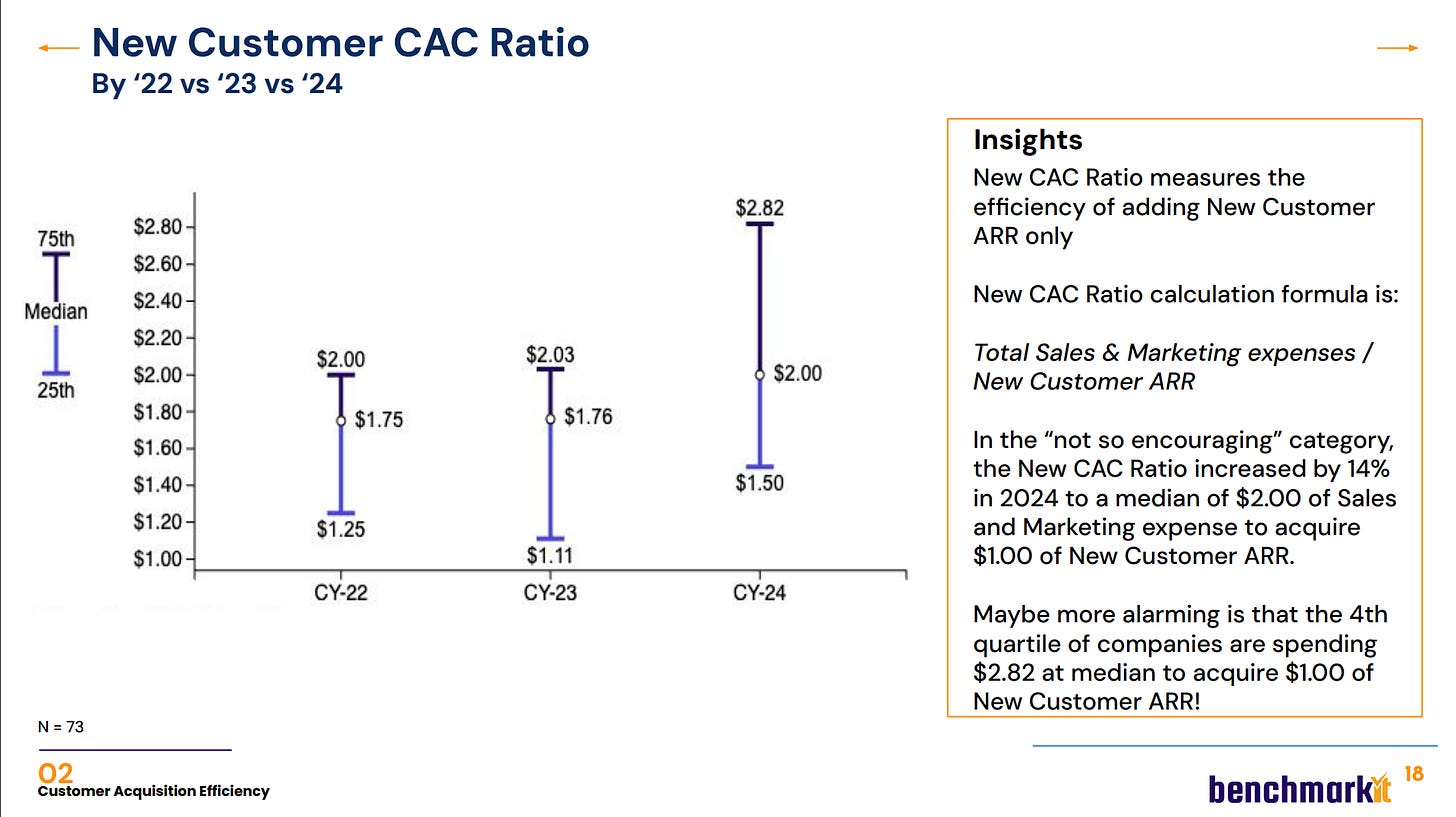

This isn't just a marketing KPI issue; it's a financial reckoning. Recent benchmarks from firms like Benchmarkit show the median New CAC Ratio has jumped 14% to a painful $2.00 for every $1.00 of new ARR. As the most efficient acquisition channel gets choked off, companies are forced into more expensive channels, turning inward to expansion revenue not as a strategy, but out of necessity.

Reframing the Problem: It's Not Lost Traffic, It's Lost Trust

So, what do we do? The instinctive reaction is to panic about traffic or chase new vanity metrics like "AI mentions" to replace the old ones. I think this is a mistake.

To focus on lost traffic is to miss the point entirely.

The real casualty here is trust. Because if you can't trust your data, you can't make sound decisions. And I've always believed that measuring the wrong thing accurately is worse than measuring the right thing approximately.

The traditional marketing dashboard is now, more than ever, a house of lies.

Last-click attribution, already a flawed model, is now dangerously obsolete. It's blind to the "dark funnel" where buyers are actually influenced: in communities, on podcasts, and now, inside AI chat interfaces. In our own work, it’s not uncommon to find significant gaps between what software attribution says and what buyers self-report.

Relying on these broken models forces investment in the wrong things, creating a deep rift between GTM teams and leadership. Every budget conversation becomes a battle because the line between action and outcome is hopelessly blurred. Trust erodes. The Data-Decision Disconnect becomes a chasm.

Sketching a New Compass

To navigate this new reality, we have to stop trying to fix the old model and start exploring a new one. This requires a shift in how we think about measurement and value creation. Here are the most promising paths I'm seeing.

1. Explore a Hybrid Measurement Model

The search for a single source of truth is over. It never really existed. The most forward-thinking RevOps & Go-to-Market leaders I see are building a new compass by combining signals from three sources:

Machine Listening: Analyze what's left. Server logs are a great start. Seeing which content assets AI crawlers ingest is a fascinating new leading indicator for influence. If the AI doesn't see you as authoritative, no human ever will.

Mindshare Measurement (Share of AI Voice): Track your brand's visibility within AI answers. When a target buyer asks a commercial question, does your brand show up? This feels like a very new but critical piece of the puzzle.

Human Listening (Self-Reported Attribution): Get to the ultimate ground truth. Ask your highest-intent prospects, "How did you hear about us?" This simple field is one of the most potent tools for illuminating the dark funnel.

This hybrid approach feels like the first, essential step toward a Unified RevOps Data Framework: a system where sales, marketing, and CS can finally view the same map, even if the terrain is foggy.

2. Build a Data Moat, Not More TOFU Fodder

The era of churning out high-volume, low-defensibility "what is..." articles is over. AI can do that better and faster. It seems the new content strategy must center on building a Data Moat: a portfolio of proprietary assets that an AI cannot simply summarize, but is forced to cite.

Put simply: Your content is no longer bait for a click; it’s an application for a job in the AI's brain.

This likely means investing in things like:

Proprietary Data & Research: Commissioning your own industry surveys and benchmark reports. Become the primary source for AI to refer back to.

Powerful Tools: Building interactive ROI calculators or assessment tools that provide personalized value an AI can't replicate.

Strong, Defensible Opinions: In a world of AI-generated consensus, a sharp, data-backed point of view becomes a powerful differentiator.

The Questions I'm Pondering Now

This isn't a "wait and see" situation. The leaders who will build a durable advantage from this chaos will be the ones who start asking better questions.

To navigate this, our focus must shift from the vanity of clicks to the substance of influence. Here are the three strategic questions I'm wrestling with, and that I believe every B2B leader should be discussing with their teams:

"Are we measuring what's easy, or what truly matters?" This is the moment to challenge your dashboards. What would happen if you ran a Hybrid Measurement Model in parallel for 90 days? What insights would you uncover by simply asking customers how they found you?

"Is our content an echo, or is it a primary source?" What if we reallocated a portion of our content budget away from volume and toward one high-impact, defensible "Data Moat" asset? How would we measure its success differently? Not by pageviews, but by citations and influence?

"Are our teams aligned around a funnel, or around the customer?" The blame game gets loudest when data is disconnected. What could a small, cross-functional "outcome pod" (group of people organized by achieving an outcome instead of their organizational hierarchy/silo) achieve if it were freed from siloed KPIs and focused on a single customer goal?

The way we go to market is being redrawn in real-time. Flying blind isn't an option. The challenge for all of us is to start asking the right questions, to build a new compass, and to fortify the unique value that no AI can scrape away.

What's Next? An Open Exploration.

We’ve established that the old funnel is a black box. But what new model replaces it? That's what I'll be exploring over the next few weeks. This series is my open-ended attempt to connect the dots and figure out what comes next.

We'll be diving into questions like:

What do the new B2B Buyer Intent Signals look like in an AI-Agent world?

What if your data is now more valuable than your product? We'll explore the economics of the "Two-Tiered Web" and the strategy for building a Data Moat that AI is forced to cite.

Who is your customer when they're no longer human? Will we still be selling to humans, or will it be buyer and seller agents that take over?

If you're also wrestling with these questions, subscribe below to join the exploration. I would love to read your thoughts in the comments or via DM. I’m active on LinkedIn, X and Substack.